Products

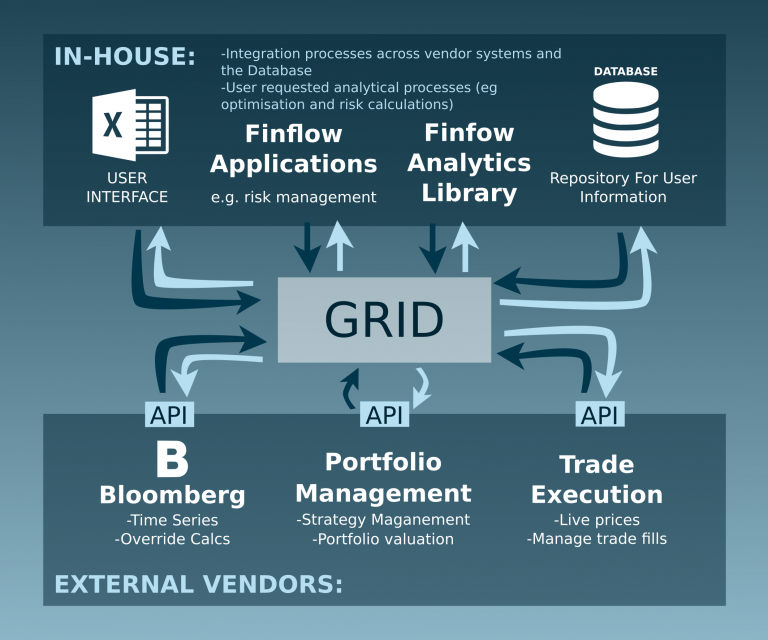

Finflow Grid:

Tool-Kit for development

- Allows rapid development of resilient processes, using Finflow’s proprietary development framework

- Allows communication between processes (ranging from simple algo calculations to trade execution) and a user, via Excel or a bespoke GUI

- While Excel is used as an interface, all data persists on an integrated SQL database, and processing times are not held back by Excel’s performance

Pre-trade Analytics

Finflow Back Testing

Back-Tester

- Performs systematic back testing of trade ideas

- Incorporates, fundamental research (“Rich/Cheap”), technical analysis and machine-learning sentiment

- Allows the user to “pick and mix” combinations, and configure through an agile interface to see P&L from various scenarios

Finflow Model Template

Fundamental Research Models

- Provides “Rich/Cheap” analysis of a company in relation to its sector peers

- Provides a structured repository, and contains all relevant corporate data (balance sheet info, sales projections, etc.)

- Proprietary data can be incorporated through an interface mechanism, and allows sensitive data to remain entirely within the client environment

Finflow Grid XL

Spread-sheet Optimisation

- Refactors legacy spread-sheets to interface with a database, and allows some or all of the more complex calculations to be moved into an appropriate programming language

- Makes use of Excel, data sources, interfaces to 3rd party vendor systems through api’s and maintains data on a central database

- Spread-sheets can be standardised, perform more efficiently, and invaluable data is never lost

Finflow Algo

Signal Generator

- Extracts pre-defined underlying data and applies assumptions (set, after back-testing) for the generation of trade ideas

- Integrates time-series cleansing, “date matching”, fundamental data, technical data, stop/loss criteria, proprietary data (“ring-fenced”), sentiment data

- Allows user to drive the process, and examine/modify underlying assumptions – also, integrates with trade workflow to allow systematic order execution

Trade Execution

Finflow Grid Order Workflow

Order Management

- Manages order origination and dynamic hedging

- Integrates portfolio management and broker trade execution systems, together with in-house algo mechanisms and stop/loss risk management systems to both monitor and manage positions

- Allows 3rd party portfolio management and broker trade execution systems to integrate with in-house systems, for systemaric processing

Post-trade Attribution

Finflow Risk Engine

Risk Management

- Provides calculations for risk-weighting positions and stop/loss triggers for entry and exit of positions

- Provides all relevant calculations for risk, stop/loss events and ensures portfolio is hedges

- Ensures portfolio is hedged in line with expectations

Finflow Portfolio Attribution

Portfolio Attribution

- Provides position re-balancing data to allow exposure in smart beta criteria

- Provides all relevant calcuations for betas, and applies them to the portfolio

- Ensures portfolio has correct beta exposure